Featured

Table of Contents

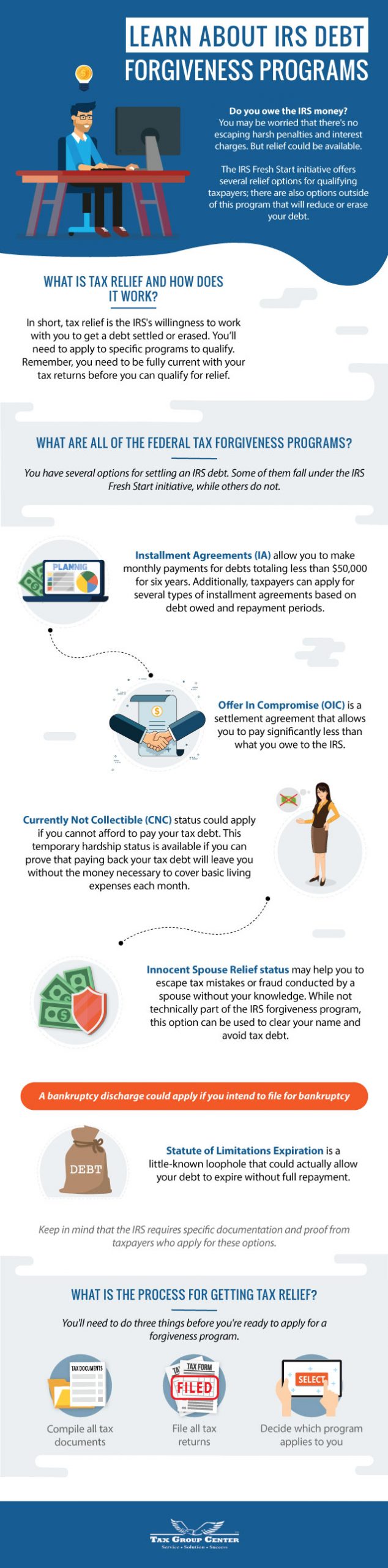

The catch is that nonprofit Bank card Financial debt Mercy isn't for everybody. To certify, you need to not have made a repayment on your credit card account, or accounts, for 120-180 days. Furthermore, not all lenders take part, and it's only supplied by a couple of not-for-profit credit score counseling companies. InCharge Financial obligation Solutions is among them.

The Credit Report Card Mercy Program is for people that are so much behind on credit card repayments that they are in major monetary difficulty, potentially facing insolvency, and do not have the revenue to catch up."The program is specifically made to aid customers whose accounts have actually been charged off," Mostafa Imakhchachen, consumer treatment specialist at InCharge Debt Solutions, stated.

Financial institutions who take part have agreed with the not-for-profit credit rating therapy firm to accept 50%-60% of what is owed in taken care of monthly repayments over 36 months. The fixed repayments indicate you recognize specifically just how much you'll pay over the settlement duration. No interest is billed on the balances throughout the payback period, so the payments and amount owed do not transform.

But it does show you're taking an active role in lowering your debt. Because your account was currently method behind and charged off, your credit rating was already taking a hit. After negotiation, the account will certainly be reported as paid with a zero balance, instead of exceptional with a collections company.

Top Guidelines Of The Advantages and Disadvantages When Considering Bankruptcy

The therapist will certainly evaluate your financial resources with you to figure out if the program is the right option. The evaluation will certainly include a check out your monthly income and expenditures. The agency will pull a credit score report to understand what you owe and the extent of your challenge. If the mercy program is the best remedy, the counselor will send you a contract that information the strategy, consisting of the amount of the month-to-month payment.

If you miss a repayment, the arrangement is nullified, and you should exit the program. If you believe it's an excellent option for you, call a therapist at a nonprofit credit history counseling agency like InCharge Financial debt Solutions, who can answer your concerns and help you identify if you certify.

Due to the fact that the program enables customers to go for much less than what they owe, the lenders who take part desire peace of mind that those that make use of it would not have the ability to pay the sum total. Your credit report card accounts additionally should be from banks and charge card business that have actually accepted take part.

Everything about Knowing Your Rights Related to Debt Forgiveness

Balance must be at the very least $1,000.Agreed-the equilibrium should be paid off in 36 months. There are no extensions. If you miss a payment that's just one missed payment the arrangement is ended. Your lender(s) will certainly terminate the plan and your equilibrium returns to the original quantity, minus what you have actually paid while in the program.

With the mercy program, the lender can rather select to keep your financial obligation on guides and recover 50%-60% of what they are owed. Nonprofit Charge Card Financial debt Forgiveness and for-profit debt negotiation are similar because they both give a means to settle charge card debt by paying much less than what is owed.

Credit report card forgiveness is designed to set you back the consumer less, settle the debt quicker, and have less disadvantages than its for-profit counterpart. Some crucial areas of distinction between Credit Card Financial debt Mercy and for-profit debt negotiation are: Credit history Card Financial obligation Forgiveness programs have connections with creditors that have agreed to take part.

The Buzz on Calculating the Investment of Debt Forgiveness Programs

Once they do, the payoff period begins instantly. For-profit financial debt settlement programs work out with each lender, typically over a 2-3-year duration, while interest, costs and calls from financial obligation collectors proceed. This implies a bigger hit on your debt report and credit scores score, and an increasing equilibrium till settlement is finished.

Charge Card Debt Mercy clients make 36 equal regular monthly payments to eliminate their financial obligation. The payments go to the creditors up until the agreed-to equilibrium is eliminated. No interest is charged during that period. For-profit debt settlement customers pay into an escrow account over a negotiation duration toward a lump sum that will be paid to lenders.

Table of Contents

Latest Posts

The Best Strategy To Use For Resources Provided Via Certified Counselors

Some Known Factual Statements About Warning Signs While Evaluating a Housing Counseling Services : APFSC Guidance for Homeownership Provider

The Basic Principles Of Evaluating Bankruptcy Counseling Organizations in the Industry

More

Latest Posts

The Best Strategy To Use For Resources Provided Via Certified Counselors

The Basic Principles Of Evaluating Bankruptcy Counseling Organizations in the Industry